Lone Star Clean Fuels Alliance and other Clean Cities organizations in our national network collect data during the 1st quarter from stakeholders on their use of alternative fuels, electric vehicles, advanced vehicle technologies and fuel saving strategies during the prior year. This helps us support our stakeholders in the options that meet their needs through targeted education, identifying funding and peer mentoring opportunities and publicizing their efforts.

We annually acknowledge the stakeholders completing the survey for their innovation in the above categories and their efforts in improving air quality and fuel diversity. For a list of participating organizations, visit our Fleet Recognition webpage.

Access the Webinar Recording, Resource Guide & Presentations

Renewable natural gas is fully interchangeable with conventional natural gas and can be used in the same pipeline, equipment, etc. It can be made from landfill, livestock or crop waste. Currently there are 35 natural gas production plants with more coming online. Scroll to the last page of the guide for the Coalition for Renewable Natural Gas’s list of RNG plants currently or soon-to-be operating in Texas.

Renewable propane is made primarily from plant and vegetable oils, animal fats or used cooking oil and is fully interchangeable with conventional propane and can be used in the same tanks and equipment, etc. The Propane Education and Research Council reports significant investments made in propane feedstock and refineries which are projected to increase availability and decrease costs of renewable propane beginning in 2024.

We annually acknowledge the stakeholders completing the survey for their innovation in the above categories and their efforts in improving air quality and fuel diversity. For a list of participating organizations, visit our Fleet Recognition webpage.

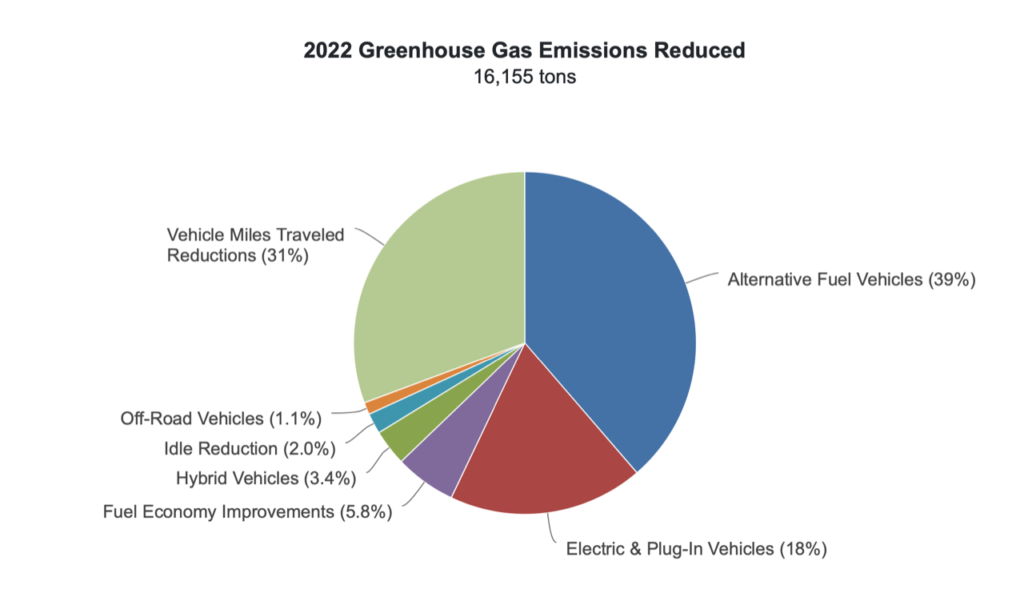

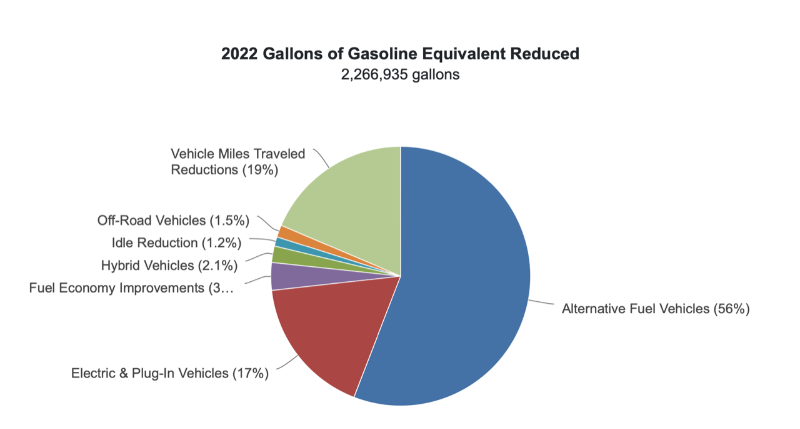

The 2022 alt fuel stats for our five-county area are graphically represented below:

Ford Pro Offering New EV Chargers for Fleet Customers

Ford Pro, the commercial division within Ford Motor Company, has debuted new charging hardware in its suite of EV solutions, including the Series 2 AC Charging Station 80 A and expanded DC fast charger options. Coupled with Ford Pro’s charging management software, the company provides a fully integrated solution that simplifies EV charging for both Ford and non-Ford electric vehicles. Of interest to the biofuel and bioenergy industries, the newly signed law establishes new tax credits for sustainable aviation fuel (SAF), clean transportation fuels and clean hydrogen. It also extends several existing tax credits that benefit transportation biofuels, such as renewable diesel and biodiesel, and includes funding for biofuel infrastructure development.

DOE Tools – Station locator updated

Looking for stations for any fuel type? Planning a trip using an alternatively fueled vehicle? This database is operated by the National Renewable Energy Lab and includes all networks and fuels. The stations are verified on a regular basis. The station locator can do many things: Check it out – on the DOE’s Alternative Fuels Data Center – scroll down to the lower right hand side. You can download the iPhone app or Android version. The new system, which monitors up to 156 data points including vehicle location, state of charge, energy usage, efficiency, lifetime metrics with total driving hours, energy usage, vehicle health and many other important vehicle metrics, is integrated into every new Lightning eMotors vehicle. Additionally, Lightning Insights provides complete control over Lightning’s fleet charging solutions including charger access, charge time scheduling, load management, payment methods and more.

Cummins, Chevron Double-Down on Alt Fuels for Transportation

Cummins Inc. and Chevron U.S.A. Inc. have inked a memorandum of understanding aimed at taking advantage of the companies’ “complementary positioning” in natural gas, hydrogen and other low-carbon alternative fuels. Cummins and Chevron are already engaged in a strategic collaboration on hydrogen and renewable natural gas, and they are expected to work on other liquid renewable fuels, such as renewable gasoline blends, biodiesel and renewable diesel.

| | STATUS |

Emissions Reduction Incentive Grants Program (ERIG) |

CLOSED | |

Texas Natural Gas Vehicle Grants Program (TNGVGP) | CLOSED | |

Seaport & Rail Yard Areas Emissions Reduction Program(SPRY) | CLOSED | |

Texas Clean Fleet Program (TCFP) | CLOSED | |

Light-Duty Motor Vehicle Purchase or Lease Incentive Program (LDPLIP) | CLOSED | |

Rebate Grant Program (Rebate) | CLOSED | |

Texas Clean School Bus Program (TCSB) | CLOSED | |

| Alternative Fueling Facilities Program (AFFP) | CLOSED | |

New Technology Implementation Grant (NTIG) | CLOSED | |

Governmental Alternative Fuel Fleet Grant Program (GAFF) | CLOSED |

Diesel Emissions Reduction Act (DERA)

Program Accepting Applications

The United States Environmental Protection Agency has announced the 2022-2023 Diesel Emissions Reduction Act (DERA) National Grant Program. Funding is now available for projects that will reduce emissions coming from existing diesel vehicles. The program plans to give out approximately $115 million in funds to applicants.

DERA applications are due by Friday, December 1, 2023. To learn more about eligibility and this opportunity, please go here.

Texas Volkswagen Environmental Mitigation Program

Electric Forklifts and Port Cargo Handling Equipment: Opening Soon

Electric Airport Ground Support Equipment: Opening Soon

Grant Programs

EVENTS

Upcoming Lunch and Learn Webinar Workshop

How to Apply for the Natural Gas and Propane

Motor Vehicle Federal Tax Credit Webinar Workshop

December 5, 2023 12:00 noon – 12:45 pm Central Time

The Inflation Reduction Act of 2022 has extended the $0.50/Gallon Natural Gas/Propane Federal Tax Credit through December 31, 2024.

Heather Ball of the Texas Natural Gas Foundation will walk us through how to claim the credit. If you own natural gas or propane vehicles or forklifts and fuel at your refueling site, you are eligible to claim the credit. This includes public fleets, non-profits and private companies. You do not need to pay taxes to claim the credit.

Wondering How to Right Size your Fleet?

Here are two opportunities to Test Drive AYRO’s newly released Vanish!

The Inflation Reduction Act of 2022 has extended the $0.50/Gallon Natural Gas/Propane Federal Tax Credit through December 31, 2024.

he AYRO Vanish is a utility low-speed electric vehicle (LSEV) addressing a market that falls between full size trucks and golf and utility carts. The vehicle offers highly adaptable bed configurations to support both light-duty and heavy-duty needs in a variety of applications.

Join LSCFA member, AYRO, for an exclusive opportunity to get behind the wheel of the 2023 AYRO Vanish. During this one-of-a-kind event, you’ll have the opportunity to test drive their newest vehicle, and their team of experts will be on hand to guide you through all the features and capabilities of the vehicle as well as answer any questions.

Or you can choose to visit their manufacturing facility in Round Rock during their Texas Road Show to test drive their low-speed electric truck and tour their facility.

September 14 @ 10:00 am – 3:00 pm CDT Texas Roadshow: Austin

AYRO Headquarters 900 E. Old Settlers Boulevard, Suite 100, Round Rock, TX, United States

Register for more information

Subscribe to our newsletters for the latest updates, events, and insights.

A U.S. Department of Energy designated coalition in the Clean Cities and Communities partnership.